- H1 2025 records the lowest M&A activity on record, as insurers steer clear of deals due to persistent economic, geopolitical, and regulatory headwinds

- Carriers adopt a cautious capital strategy, favouring share buybacks and modest bolt-on acquisitions over large-scale transactions

- Deferred demand expected to shift towards regional market opportunities and MGA consolidation in the second half of the year

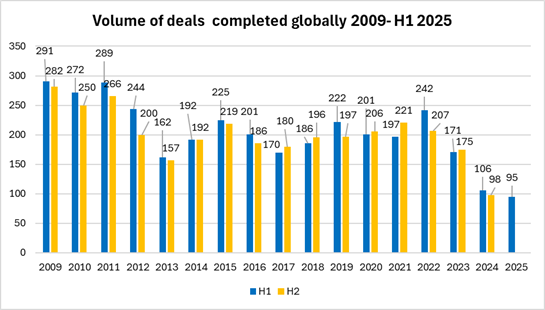

Global insurance carriers largely refrained from dealmaking in the first half of 2025, with merger and acquisition activity dropping to its lowest level since the 2008 financial crisis.

Over the first six months of the year, just 95 transactions were completed—down from 106 during the same period in 2024 and well below the 10-year H1 average of 192 deals.

Carrier caution was abounded during this period, fuelled by a combination of ongoing geopolitical uncertainty, inflationary concerns and wider economic turbulence, and stubbornly high valuations.

With reported interest from private equity bidders also falling, carriers sought to retain their war chests, instead selectively pursuing smaller bolt-on deals, share buybacks and organic investment projects instead.

Carriers in the US made selective acquisitions, with notable deals crossing the line over the period, including Sentry Insurance’s $1.7bn acquisition of The General from American Family insurance, while Markel’s acquisition of the UK’s MECO, a specialist marine MGA, highlighted the ongoing interest in the MGA market[1].

However, cross-border deals were few-and-far-between during H1, with carriers focussing on domestic opportunities, including several small-scale tie-ups in the Bermudian market.

In the Middle East, dealmaking generally remained muted, with some activity being seen across the life sector, prompted by international players seeking expansion into regional and healthcare markets.

Carrier activity in the UK and Europe was subdued, with non-carrier deals in the broking and intermediary spaces more evident.

North America posted the largest number of deals completed in the period at 35, compared to 29 across EMEA, 25 in the APAC region and just four deals in Latin America. According to the data there were 21 cross border deals completed over the period.

Share buybacks were a feature of the period, particularly in Japan and across Asia, as listed carriers sought to take advantage of relatively low share prices to buy their own shares.

The first half of the year ended with a number of deals being announced, including Zurich’s acquisition of AIG’s Global Personal Travel Insurance and Assistance business for $600m. The deal is expected to close in the second half of 2025.

Peter Hodgins, Partner and Global Head of Corporate Insurance, said: “There are a host of factors putting the brakes on global carrier M&A including ongoing geopolitical tensions, tough economic conditions and regulatory uncertainty. Getting deals done is hard and they are taking longer to complete. But there’s evidence to suggest that pent up demand from carriers looking for strategic growth will result in higher activity in the second half of the year.”

He added: “There are several large carriers in the market that have voiced their ambitions to make acquisitions this year. There are number of high-profile processes that are continuing, while listed valuations may increase the appetite of some players to make inorganic moves. We also are seeing evidence that international carriers are readying themselves for M&A that gets them access to higher growth emerging markets. The MGA story will continue into the second half of the year and into 2026, with continued aggregation of multi-jurisdictional capabilities that grants carriers access to new markets.”