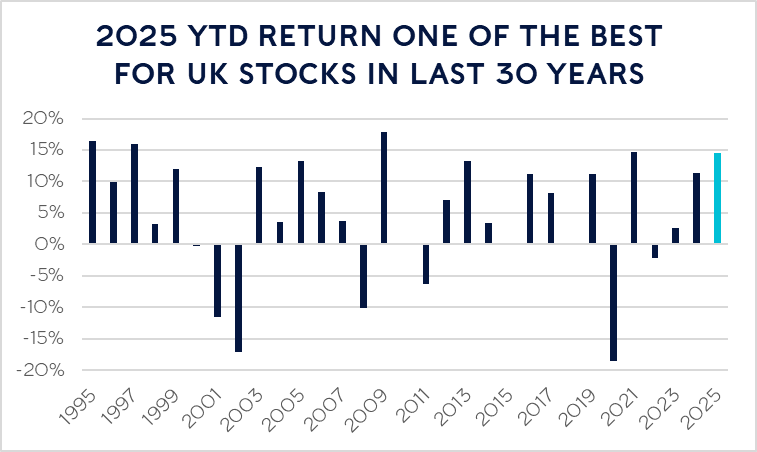

Despite ongoing global uncertainty, UK equities have recorded one of their best year-to-date results in thirty years, according to new analysis by Rathbones, one of the country’s leading wealth and asset managers.

In the year to 31 August 2025, the FTSE All-Share Index achieved a total return of 14.5%, outpacing nearly all major markets except Germany’s DAX. This places 2025 as the fifth strongest year for UK shares since 1995, a remarkable achievement against a backdrop of stubborn inflation, higher government bond yields, and muted economic expansion.

By comparison, sterling-based investors in the US S&P 500 have seen returns of only 3%, held back by a weaker dollar, while the MSCI World Index has risen by just 5%.

“UK equities have defied expectations this year,” said Alexandra Jackson, Fund Manager of the UK Opportunities Fund at Rathbones. “Despite all the doom and gloom, the All-Share has delivered one of its best year-to-date performances in three decades – a reminder that markets often move ahead of the headlines.

“While investors remain cautious about government debt and inflation, strong company earnings and resilient demand have underpinned returns. This performance shows why the UK should not be overlooked in a diversified portfolio.”

Global backdrop: tug-of-war between growth and inflation

This August reflected the broader global push and pull between inflationary pressures and growth resilience. New US tariffs sparked an initial “risk-off” market reaction, but global GDP forecasts were revised higher as businesses front-loaded production ahead of the deadline. Meanwhile, government bonds sold off sharply, with long-term UK gilts just below 5.7% and US Treasuries approaching 5%, signalling investor unease about rising deficits and sticky inflation.

In the UK, the Bank of England delivered its first rate cut since May, trimming the benchmark to 4.0% amid firmer short-term activity. Services sector data rose to 54.2, while inflation remained stubborn at 3.8%. Despite the mixed signals, GDP growth was stronger than expected, suggesting the UK economy is edging towards a soft landing.

Equities buck the pessimism

Against this backdrop, UK equities surprised on the upside. The All-Share’s 14.5% return puts 2025 alongside standout years such as 2009 (+17.8%) and 2021 (+14.7%), and ahead of strong post-crisis years like 2013 (+13.3%) and 2005 (+13.2%).