For years, a woman operating in the financial markets was someone unique. In the 21st century, there has been a dynamic change and the share of women among all investors is increasing year by year. Who is the typical woman-investor? Data on this was shared by the XTB Group.

The last three years have been a time when financial markets have become extremely popular. In 2020, we were dealing with low interest rates, increased digitization, and lockdown. The last one meant that people had more time to get acquainted with how financial markets work. Especially nowadays in many places, e.g. on the XTB platform, you can find a lot of free knowledge about investing.

However, 2022 is a year of huge volatility of the markets, caused by the tense geopolitical situation. Inflation all over the world took its toll on people and it motivated a large part of society to try to protect the accumulated capital, including through operations in the financial markets.

Financial markets are becoming more feminine

According to data from the XTB investment platform, in 2022 the share of women among new clients was record-breaking. It amounted to 16%. Until recently, this percentage was much lower, but in recent years it has started to increase. What can cause this?

– The so-called gender gap, i.e. the difference between the percentage of men and women who are new participants in the capital market, is 68%. This means that, although in the minority, women exist in this industry, and the observed growing trend is a positive signal. As the main reason for the growing participation of women, I would point to a change in the attitude of women themselves in the modern world, who are professionally active, creative and take action in areas previously considered the domain of men. There is an aspect of gender competition here, or an attempt to prove that women, just like the opposite sex, can achieve success in this field – comments Dr. Anna Szczepańska-Przekota from the Koszalin University of Technology.

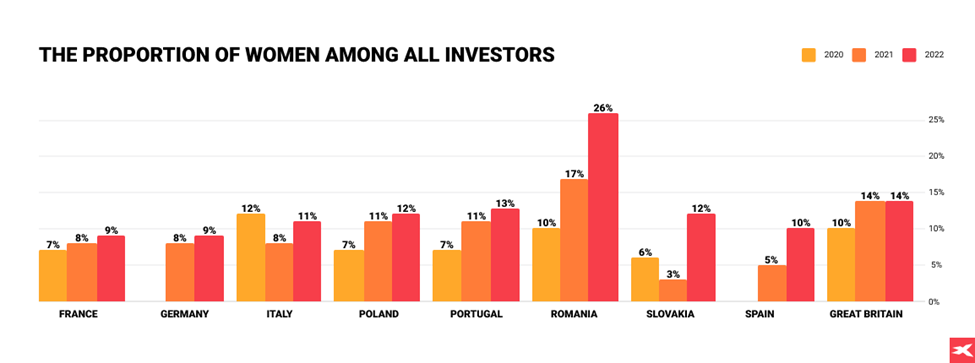

Data on the share of women among all investors are even more interesting, by country. According to XTB data, the largest share of female investors among financial market participants is in Romania – 26%. This result can be a model for others, as the second country with the highest share of women is Great Britain. There they account for 14 percent of total investors. The lowest percentage of women among investors is in the Czech Republic, France and Germany. These are the only markets where it is currently below 10%.

[table 1 – women’s share]

This is how women’s investments look like

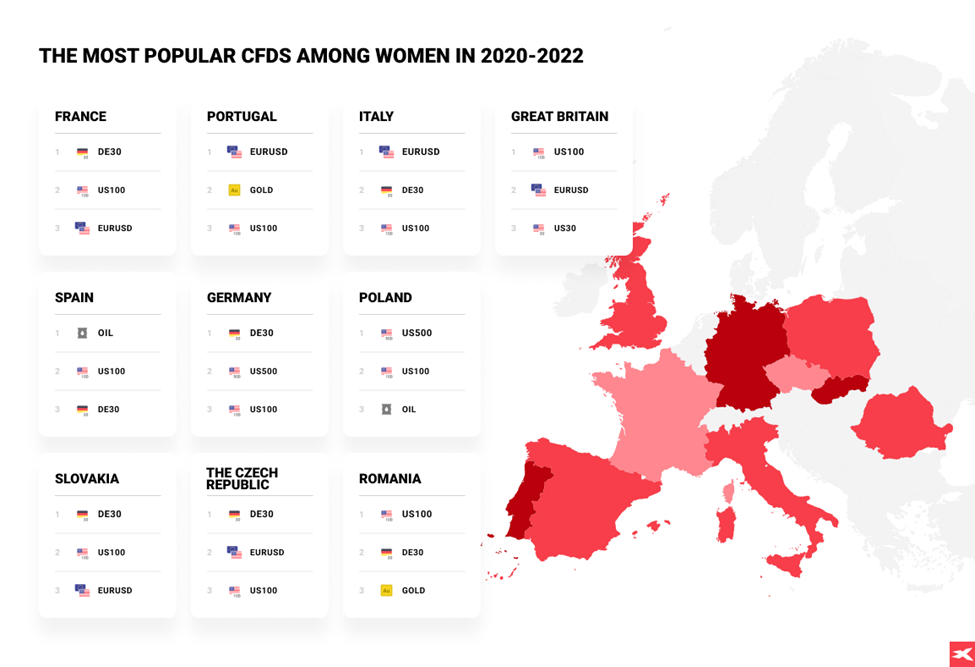

Over the years, there have been many stereotypes about the presence of women in the financial markets. The facts, however, turn out to be quite different. Women and their investment choices do not differ significantly from what can be observed among men. In the years 2020-2022, women most often chose CFDs on world stock indices. In this case, two markets dominated – American and German.

[table 2 – Women investment – CFDs]

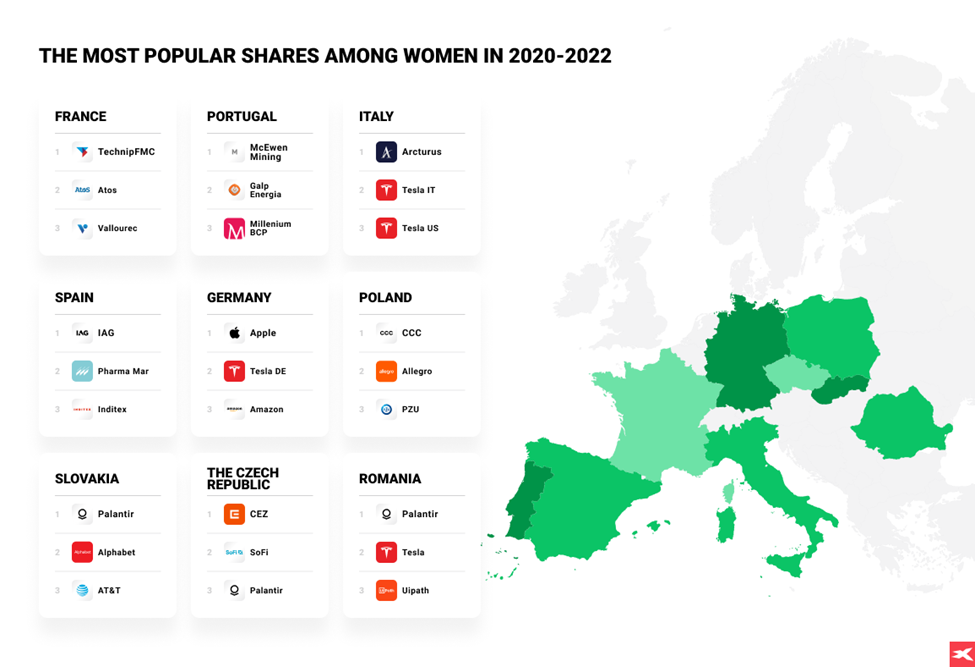

Interesting conclusions can also be drawn by looking at the choices of women on the stock market. In the years 2020-2022, women clearly chose investing in BigTechs. Suffice it to say that during this period, on the XTB platform, women most willingly purchased shares of three American companies – Palantir Technologies, Tesla and Apple. This, however, does not mean that the ladies did not believe in local companies. Data from individual countries show that regional sentiment was strongly visible. In the discussed period, CCC was the most popular in Poland, CEZ in the Czech Republic, TechnipFMC in France, and International Consolidated Airlines Group in Spain.

[table 3 – Women investments – stocks]

How does a woman in the market differ from men?

XTB data show that a woman on the financial market is a user with a slightly different profile than a man. First of all, the ladies are a bit older. In their case, the average age is 37, and for men it is 35. However, the biggest difference is in the way of investing.

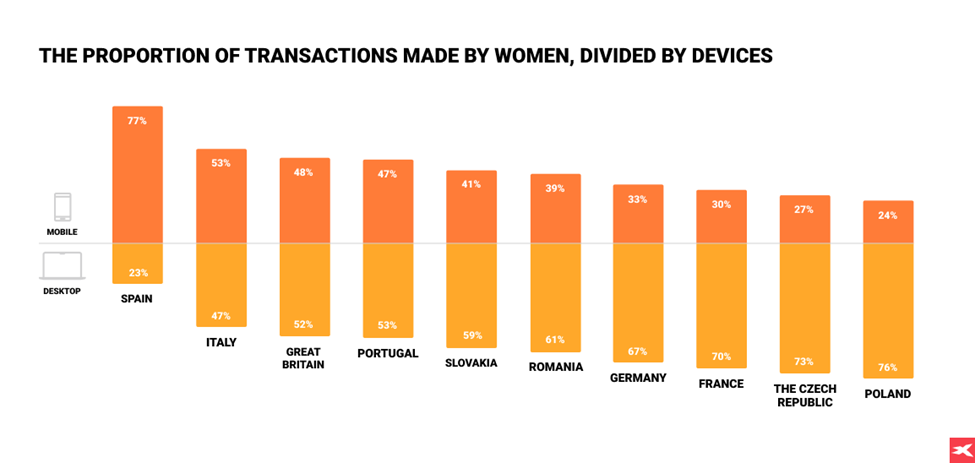

In recent years, among men, investing has been done more often via mobile devices. However, it can be noticed that women are more traditionalists. As much as 59 percent of transactions initiated by women were carried out via a desktop application, i.e. using a computer.

– Indeed, the disproportion in the use of devices for investment is large, but in my opinion it is not surprising. I would indicate two reasons for thi: human nature and time – says Dr. Szczepańska-Przekota.

– Women are naturally more cautious, they need more information to make decisions. Women take more time to make an investment decision, but they do it based on in-depth analyses, often using various types of consultations. Making transactions through the desktop application creates a sense of greater control and security over your finances. Men, on the other hand, make decisions faster, are less patient, and don’t ask anyone’s opinion. That is why mobile devices are their ally – analyzes the expert from the Koszalin University of Technology.

Women can take over financial markets

The times in which the stereotypical approach to the “division of roles in households” was dominant are passing. As a society, we strive to build partnerships in which everyone should have space for self-development. The potential for a dynamic increase in the number of women on the financial markets is huge because at universities they willingly choose economics, e.g. in Poland they outnumber men. So what should be done to encourage women to be more active in managing their finances?

– The right direction will be didactic activity in the field of financial self-education of women. National and international organizations, clubs and associations can help in supporting women by offering accessible teaching materials and workshops for women. Maybe this action will become a springboard to the world of investments – suggests Dr. Anna Szczepańska-Przekota.

– An important issue on the labor market is the actions taken by employers to help women reconcile their career with the role of a mother. Tools in the form of offering women the possibility of part-time work or enabling flexible working hours allow for the creation of conditions for the development of individual management qualities of women – concludes the expert.

Media contact:

Artur Babicz

PR Specialist

m. +48 666 891 149

Mail: artur.babicz@xtb.pl